Ira required minimum distribution worksheet

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The following tips can help you fill out Ira Required Minimum Distribution Worksheet quickly and easily.

Publication 590 Individual Retirement Arrangements Iras Appendices

Every age beginning at 72 has a corresponding distribution period so you must calculate your RMD every year.

. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Calculate the required minimum distribution from an inherited IRA. Your RMD worksheet 2 How to calculate your RMDs Step 1.

In general RMDs must be taken separately for each of your accountsHowever if you have multiple 403b. Required Minimum Distribution Worksheet - for everyone else. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

Use the Required Minimum Distributions tax worksheet instead. Now using a IRS IRA Required Minimum Distribution Worksheet takes a maximum of 5 minutes. Fill in the required fields that are colored in yellow.

Hit the arrow with the inscription Next to move from box to box. You might need to take a little extra time in 2022 to plan your required minimum distributions RMDs from IRAs 401ks and other qualified retirement plansA few of the rules have changed. Required Minimum Distribution Worksheet - use this only if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you.

Open the form in the feature-rich online editor by clicking Get form. Required minimum distributions RMDs are amounts that US. List each tax-deferred retirement account and the balance on December 31 last year.

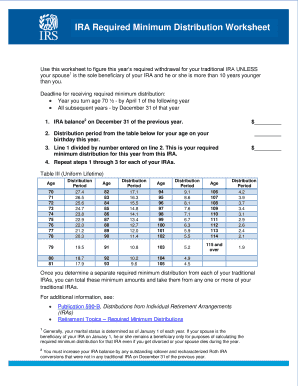

A required minimum distribution RMD. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required.

DO NOT use this worksheet for a surviving spouse who elects to treat an inherited IRA as hisher own or rolls the inherited IRA over into hisher own IRA. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdraw for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. Follow our easy steps to get your IRS IRA Required Minimum Distribution Worksheet ready rapidly.

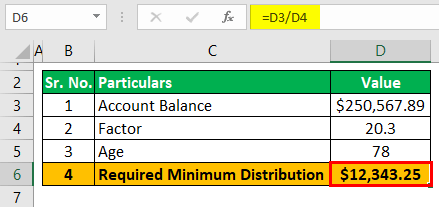

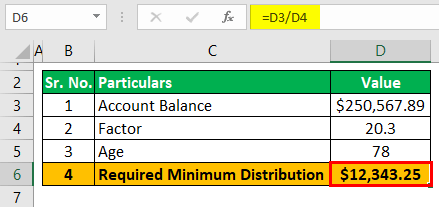

To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. This tax worksheet computes the required minimum distribution RMD a beneficiary must withdrawal from an inherited IRA. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. For example Joe Retiree who is age 80. If you want to simply take your.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Divide each balance by your life expectancy divisor see the table on the following page. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Retirement planners tax practitioners and publications of the Internal Revenue Service IRS often use the phrase. Required Minimum Distribution Calculator. Ad Whats Your Required Minimum Distribution From Your Retirement Accounts.

Paying taxes on early distributions from your IRA could be costly to your retirement. Our state online blanks and crystal-clear instructions remove human-prone mistakes. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years RMD for your traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. Wide Range of Investment Choices Access to Smart Tools Objective Research and More. Claim 10000 or More in Free Silver.

Deadline for receiving RMDs. Year you turn age 70 ½ - by April 1of the following year. Tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plansIn the Internal Revenue Code itself the precise term is minimum required distribution.

Required Minimum Distribution Calculator Estimate The Minimum Amount

2

Where Are Those New Rmd Tables For 2022

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2

2

Rmd Table Rules Requirements By Account Type

Where Are Those New Rmd Tables For 2022

Irs Required Minimum Distribution Fill Online Printable Fillable Blank Pdffiller

Khabar Navigating Your Required Minimum Distribution

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator Estimate The Minimum Amount